Understanding the QSBS Exemption: A Strategic Tax Benefit for Founders, Investors, and Early Employees

- melacksamson

- Apr 17, 2025

- 4 min read

The Qualified Small Business Stock (QSBS) exemption under Section 1202 of the Internal Revenue Code offers one of the most powerful tax planning tools available to founders, employees, and early investors in startups. If structured correctly, the exemption allows for up to 100% of capital gains to be excluded from federal tax upon the sale of qualified stock—potentially saving millions. This article outlines the core requirements, benefits, and practical considerations for leveraging the QSBS exemption.

What Is QSBS?

QSBS refers to shares in a C-corporation that meet specific IRS criteria. If held for at least five years, these shares may be eligible for exclusion from federal capital gains tax when sold. The stock must be acquired at original issuance and the issuing company must meet asset and business activity requirements.

For further reading, see this QSBS overview by Morgan Stanley and QSBS guide by Brown Advisory for practical insights on maximizing the exemption.

Key Tax Benefits

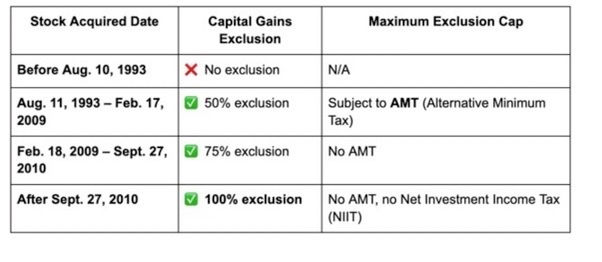

Up to 100% Capital Gains Exclusion: For QSBS acquired after September 27, 2010, taxpayers may exclude up to 100% of gains, subject to a cap.

Exclusion Cap: The greater of $10 million or 10x the taxpayer’s original investment.

No AMT or NIIT: For post-2010 QSBS, the Alternative Minimum Tax (AMT) and Net Investment Income Tax (NIIT) do not apply to the excluded gains.

If acquired after Sept. 27, 2010 → 100% capital gains tax exclusion on up to $10 million or 10x the original investment, whichever is greater.

QSBS Eligibility Criteria

To qualify for Section 1202 treatment, the following conditions must be met:

C-Corporation Structure: The issuing company must be a U.S. C-corp at the time of issuance and at sale. LLCs and S-corps are ineligible.

Qualified Small Business Status: The company must have gross assets of $50 million or less at the time of stock issuance.

Original Issuance: The taxpayer must acquire the stock directly from the company, not through secondary purchases.

Five-Year Holding Period: The stock must be held for at least five years to claim the exclusion.

Active Business Requirement: At least 80% of the company’s assets must be used in an active business. Certain sectors—such as professional services, finance, real estate, and hospitality—are excluded.

What If You Sell Early?

If stock is sold before the five-year threshold, Section 1045 allows taxpayers to defer gains by rolling the proceeds into new QSBS within 60 days. This rollover provision can preserve future eligibility.

How to Claim the Exemption

Claiming the QSBS exclusion requires proper documentation and timely reporting:

Confirm Eligibility: Work with counsel or a tax advisor to verify the company's structure, asset base, and industry.

Track Dates: Maintain clear records of the acquisition and sale dates.

File Proper Forms: Use IRS Form 8949 and Schedule D when reporting gains.

Apply Section 1202: Ensure your tax return reflects the QSBS exclusion under Section 1202.

Illustrative Examples

If an investor acquires $500,000 in QSBS and sells it for $7 million, the $6.5 million gain may be entirely tax-free.

If a founder invests $2 million and later sells for $25 million, they can potentially exclude up to $20 million in capital gains (10x their basis).

Key Considerations

The company must remain compliant during the holding period (e.g., retaining C-corp status, staying within qualifying industries).

Timing matters—even a shortfall in the five-year period can forfeit the exemption.

QSBS treatment applies on a per-issuer basis, and taxpayers may utilize multiple $10M/$10x exemptions across different companies.

Final Thoughts

Section 1202 provides a unique tax advantage for those participating in the growth of early-stage companies. Founders, employees, and angel investors should evaluate whether their equity qualifies as QSBS and take proactive steps to maintain eligibility. With proper planning, the QSBS exemption can unlock meaningful tax savings at exit.

For legal guidance on structuring equity and confirming QSBS eligibility, Keiretsu Law offers strategic support across corporate, tax, and transactional matters.

For further information and legal expertise, please visit our website or schedule a meeting with Keiretsu’s Brianna Gonzalez here!

Additionally, attorney and tax specialist Carlos Julca has recently joined our team at Keiretsu, bringing long-standing expertise in corporate structuring and tax planning, with a particular focus on QSBS strategies and other founder and investor-friendly tax exemptions. Please follow the aforementioned scheduling link to connect with Carlos regarding any and all tax-related questions or concerns.

Disclaimer: The foregoing has been prepared for the general information of clients and friends of the firm. This publication is distributed with the understanding that the author, publisher and distributor of this communication are not rendering legal, accounting, or other professional advice or opinions on specific facts or matters and, accordingly, assume no liability whatsoever in connection with its use. If you have any questions or require any further information regarding these or other related matters, please contact a designated Keiretsu Law representative. Pursuant to applicable rules of professional conduct, this communication may constitute Attorney Advertising.

Comments